Illustration generated with ChatGPTSEOUL, Jan. 7 (AJP) - While the KOSPI continues its record-breaking rally on Wednesday, breaching the 4,600-level for the first time in history, the unwavering appetite of South Korean retail investors for U.S. equities remains a dominant market force.

Illustration generated with ChatGPTSEOUL, Jan. 7 (AJP) - While the KOSPI continues its record-breaking rally on Wednesday, breaching the 4,600-level for the first time in history, the unwavering appetite of South Korean retail investors for U.S. equities remains a dominant market force. According to data from Koscom ETF CHECK, the most net-purchased ETFs by retail investors over the past week were the TIGER US S&P 500 and KODEX US S&P 500. Individual traders poured nearly 350 billion Korean won (US$241.7 million) into these two funds, with net purchases of 225.9 billion won and 121 billion won, respectively.

The preference for Wall Street extended to tech-heavy indices, as retail investors also snatched up 96.0 billion won of KODEX US Nasdaq 100 and 77.6 billion won of TIGER US Nasdaq 100, signaling a persistent bias toward U.S. growth stocks.

This exodus of capital into overseas markets is a long-standing trend rather than a fleeting phenomenon. Between January and October last year, South Koreans invested a net $117.1 billion in overseas securities — comprising $89.9 billion in equities and $27.2 billion in bonds.

October alone recorded a record $17.3 billion outflow. Data from the Bank of Korea further underscores this imbalance; while domestic investment in foreign securities jumped by $17.27 billion, foreign investment in South Korean equities grew by a mere $5.2 billion, highlighting a stark divergence in market confidence.

Ironically, the most popular domestic equity ETF among retail investors was the KODEX 200 Futures Inverse 2X, known colloquially as the "Gop-bus" - which tracks twice the inverse of the KOSPI 200's daily performance. Retail traders bet 116.4 billion won on a market downturn, despite the ETF plunging 15.93 percent over the past week as the index continued to climb - suggesting that a significant segment of the retail market expects an imminent correction following the recent streak of record highs.

Institutional investors, in contrast, are doubling down on the domestic rally. Over the past week, institutions focused their buying on the KODEX Leverage and KODEX KOSDAQ 150 Leverage, with net purchases of 85.8 billion won and 79.8 billion won, respectively. These leverage products provide twice the daily return of their underlying indices, reflecting institutional confidence that the domestic bull market still has room to run despite the height of the current valuation.

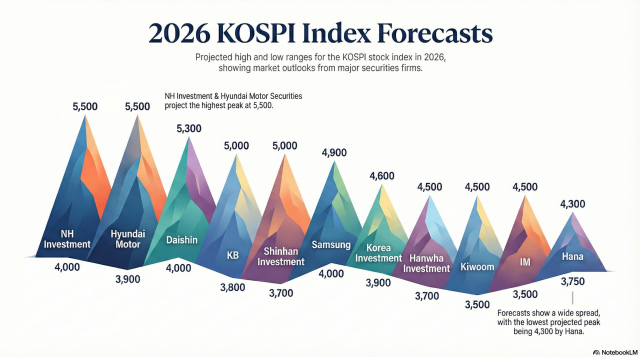

Brokerages are fueling this optimism by aggressively raising their year-end targets. Yuanta Securities recently hiked its 2026 KOSPI forecast range to 4,200–5,200 points from 3,800–4,600, while Kiwoom Securities raised its band to 3,900–5,200 points. On Tuesday, Korea Investment & Securities significantly upgraded its KOSPI target to 5,650 from 4,600, citing the high probability of further upward revisions in operating profit forecasts for semiconductor giants.

Generated with Notebook LM

Generated with Notebook LMHowever, the narrow breadth of the rally remains a point of skepticism for individual investors. The surge in the KOSPI is almost entirely dependent on a few mega-cap stocks like Samsung Electronics and SK hynix. The combined market capitalization of these two firms has reached 1,374.8 trillion won, accounting for a staggering 36.6 percent of the total KOSPI value as of Wednesday.

Historical data also serves as a cautionary tale; while the KOSPI saw explosive growth during the "Three Lows" boom of 1987–1988 and the short-term recovery after the 1997 Asian financial crisis, these rallies were often followed by stagnant or sharply declining markets, such as the 50.92 percent crash in 2000 following the IT bubble.

Analysts suggest that the anxiety over domestic volatility is driving the demand for global asset allocation toward U.S. markets. Even among experts, measuring appropriate valuations for the KOSPI has become a challenge due to its rapid ascent.

"It is historically unprecedented for the KOSPI to lead global markets with such a dominant growth rate," said an analyst at a major brokerage, on condition of anonymity, adding that market sentiment is likely to remain volatile for the time being, although the ceiling for the index remains high.

Kim Yeon-jae Reporter duswogmlwo77@ajupress.com

![[포토] 폭설에 밤 늦게까지 도로 마비](https://image.ajunews.com/content/image/2025/12/05/20251205000920610800.jpg)

![[포토] 예지원, 전통과 현대가 공존한 화보 공개](https://image.ajunews.com/content/image/2025/10/09/20251009182431778689.jpg)

![[포토]두산 안재석, 관중석 들썩이게 한 끝내기 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.1a1c4d0be7434f6b80434dced03368c0_P1.jpg)

![블랙핑크 제니, 매력이 넘쳐! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.c5a971a36b494f9fb24aea8cccf6816f_P1.jpg)

![[작아진 호랑이③] 9위 추락 시 KBO 최초…승리의 여신 떠난 자리, KIA를 덮친 '우승 징크스'](http://www.sportsworldi.com/content/image/2025/09/04/20250904518238.jpg)

![블랙핑크 제니, 최강매력! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.ed1b2684d2d64e359332640e38dac841_P1.jpg)

![[포토]첫 타석부터 안타 치는 LG 문성주](https://file.sportsseoul.com/news/cms/2025/09/02/news-p.v1.20250902.8962276ed11c468c90062ee85072fa38_P1.jpg)

![[포토] 국회 예결위 참석하는 김민석 총리](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110710410898931_1762479667.jpg)

![[포토] 발표하는 김정수 삼양식품 부회장](https://image.ajunews.com/content/image/2025/11/03/20251103114206916880.jpg)

![[포토] 박지현 '아름다운 미모'](http://www.segye.com/content/image/2025/11/19/20251119519369.jpg)

![[포토] 김고은 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905507236.jpg)

![[포토] 키스오브라이프 하늘 '완벽한 미모'](http://www.segye.com/content/image/2025/09/05/20250905504457.jpg)

![[포토] 알리익스프레스, 광군제 앞두고 팝업스토어 오픈](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110714160199219_1762492560.jpg)

![[포토] '삼양1963 런칭 쇼케이스'](https://image.ajunews.com/content/image/2025/11/03/20251103114008977281.jpg)

![[포토] 언론 현업단체, "시민피해구제 확대 찬성, 권력감시 약화 반대"](https://image.ajunews.com/content/image/2025/09/05/20250905123135571578.jpg)

![[포토] 박지현 '순백의 여신'](http://www.segye.com/content/image/2025/09/05/20250905507414.jpg)

![[포토] 김고은 '상연 생각에 눈물이 흘러'](http://www.segye.com/content/image/2025/09/05/20250905507613.jpg)

![[포토]끝내기 안타의 기쁨을 만끽하는 두산 안재석](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.0df70b9fa54d4610990f1b34c08c6a63_P1.jpg)

![[포토] 한샘, '플래그십 부산센텀' 리뉴얼 오픈](https://image.ajunews.com/content/image/2025/10/31/20251031142544910604.jpg)

![[포토] 아이들 소연 '매력적인 눈빛'](http://www.segye.com/content/image/2025/09/12/20250912508492.jpg)

![[포토]두산 안재석, 연장 승부를 끝내는 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.b12bc405ed464d9db2c3d324c2491a1d_P1.jpg)

![[포토] 키스오브라이프 쥴리 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905504358.jpg)

![[포토] 아홉 '신나는 컴백 무대'](http://www.segye.com/content/image/2025/11/04/20251104514134.jpg)