Prime Minister Kim Min-seok of South Korea and Prime Minister Mark Carney of Canada shake hands after inspecting a submarine at the Geoje Shipyard in South Gyeongsang Province on Oct. 30, 2025. YonhapSEOUL, January 09 (AJP) - A high-profile “Team Korea” delegation is set to travel to Ottawa later this month to compete in one of the world’s largest defense procurements — Canada’s plan to build 12 next-generation submarines in a project valued at more than $40 billion.

Prime Minister Kim Min-seok of South Korea and Prime Minister Mark Carney of Canada shake hands after inspecting a submarine at the Geoje Shipyard in South Gyeongsang Province on Oct. 30, 2025. YonhapSEOUL, January 09 (AJP) - A high-profile “Team Korea” delegation is set to travel to Ottawa later this month to compete in one of the world’s largest defense procurements — Canada’s plan to build 12 next-generation submarines in a project valued at more than $40 billion. Presidential chief of staff Kang Hoon-sik and Trade Minister Kim Jeong-gwan are expected to join the delegation, alongside senior executives from South Korea’s defense industry and Hyundai Motor. The deal, estimated at up to 60 trillion won ($41 billion), extends beyond naval platforms to encompass Canada’s electric-vehicle ecosystem.

According to industry sources, Ottawa is seeking highly tailored proposals from bidders. In Korea’s case, that could include commitments to establish automotive manufacturing facilities on Canadian soil. The presidential office and the Ministry of Trade, Industry and Energy declined to confirm details of the trip.

Canada’s prime minister, Mark Carney, is reported to have set specific requirements for the two shortlisted contenders: Germany’s ThyssenKrupp Marine Systems (TKMS) and South Korea’s Hanwha Ocean, which is partnering with HD Hyundai Heavy Industries.

According to CBC News, a 40-page federal evaluation document released in November places half of the total score on long-term sustainment — how bidders will maintain and support a fleet of 12 diesel-electric submarines over their lifecycle. Technical capability accounts for 20 percent, financial capacity 15 percent, and the remaining 15 percent is allocated to “economic benefits” for Canada.

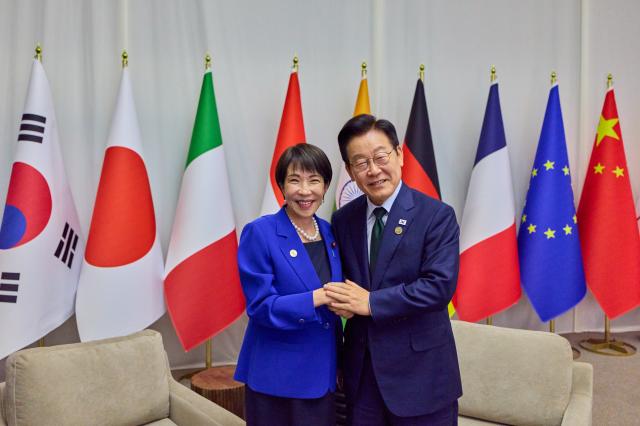

Prime Minister Kim Min-seok and Canadian Prime Minister Mark Carney visit Hanwha Ocean’s Geoje Shipyard in South Gyeongsang Province on October 30, 2025. At left is Hanwha Group Vice Chairman Kim Dong-kwan. YonhapOfficials at the newly established Defence Investment Agency have stressed that the contract must deliver maximum domestic economic impact while strengthening Canada’s defense industry.

Prime Minister Kim Min-seok and Canadian Prime Minister Mark Carney visit Hanwha Ocean’s Geoje Shipyard in South Gyeongsang Province on October 30, 2025. At left is Hanwha Group Vice Chairman Kim Dong-kwan. YonhapOfficials at the newly established Defence Investment Agency have stressed that the contract must deliver maximum domestic economic impact while strengthening Canada’s defense industry. Korea’s defense exporters have steadily built credentials across Europe and Asia, and a breakthrough in Canada could represent the next major milestone.

“This project is not simply about submarines,” said a senior Korean trade official. “It is about building a long-term partnership that spans automotive investment, energy cooperation and infrastructure.”

Lessons from Poland

The stakes are particularly high following last year’s setback in Poland. The Korean consortium, branded “Korea One Team,” lost Warsaw’s Orka submarine program to Sweden’s Saab.

Poland opted for a smaller 2,000-ton vessel suited to the shallow Baltic Sea, rather than the Koreans’ proposed 3,600-ton fleet. South Korea had even offered to donate a decommissioned Jang Bogo-class submarine as a goodwill gesture, but the bid ultimately fell short.

The loss underscored how geopolitical alignment and operational fit can outweigh price competitiveness or industrial offsets in European defense tenders.

Carney’s overtures — and Canada’s demands

In October 2025, Carney visited Hanwha Ocean’s shipyard in Geoje, touring its massive dry docks. South Korean Prime Minister Kim Min-seok, who accompanied the visit, later recalled Carney saying he was “dealing not just with a company called Hanwha, but with the Republic of Korea.”

Since then, Ottawa has reportedly presented Seoul with an 18-point industrial cooperation proposal, centered on attracting Korean investment into Canada’s struggling automotive sector.

Industry Minister Mélanie Joly highlighted that Germany’s Volkswagen offered to build an EV battery plant as part of Berlin’s bid — a move widely seen as setting a benchmark for foreign contenders.

Canadian officials have also floated cooperation in critical minerals, liquefied natural gas and hydrogen, areas that align closely with both countries’ decarbonization strategies.

Strategic calculus

For Canada, linking submarine procurement to auto and energy investment serves a dual purpose: rebuilding a manufacturing base weakened by U.S. trade frictions and securing political backing for one of the largest military purchases in the country’s history.

For Korea, the challenge lies in balancing industrial concessions with technological credibility. Hanwha Ocean’s KSS-III-class submarines rank among the most advanced diesel-electric boats in service, but Canada’s emphasis on “sovereignty and local sustainment” favors bidders willing to localize production and create domestic jobs.

The Korean consortium is required to submit its final proposal by March, with contract awards expected later this year. A win would mark the largest single defense export deal in South Korean history — and potentially the moment its shipbuilders secure a lasting foothold in the Western naval market.

Lee Jung-woo Reporter cannes2030@ajupress.com

![[포토] 폭설에 밤 늦게까지 도로 마비](https://image.ajunews.com/content/image/2025/12/05/20251205000920610800.jpg)

![[포토] 예지원, 전통과 현대가 공존한 화보 공개](https://image.ajunews.com/content/image/2025/10/09/20251009182431778689.jpg)

![[작아진 호랑이③] 9위 추락 시 KBO 최초…승리의 여신 떠난 자리, KIA를 덮친 '우승 징크스'](http://www.sportsworldi.com/content/image/2025/09/04/20250904518238.jpg)

![[포토]두산 안재석, 관중석 들썩이게 한 끝내기 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.1a1c4d0be7434f6b80434dced03368c0_P1.jpg)

![블랙핑크 제니, 최강매력! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.ed1b2684d2d64e359332640e38dac841_P1.jpg)

![블랙핑크 제니, 매력이 넘쳐! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.c5a971a36b494f9fb24aea8cccf6816f_P1.jpg)

![[포토]첫 타석부터 안타 치는 LG 문성주](https://file.sportsseoul.com/news/cms/2025/09/02/news-p.v1.20250902.8962276ed11c468c90062ee85072fa38_P1.jpg)

![[포토] 국회 예결위 참석하는 김민석 총리](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110710410898931_1762479667.jpg)

![[포토] 발표하는 김정수 삼양식품 부회장](https://image.ajunews.com/content/image/2025/11/03/20251103114206916880.jpg)

![[포토] 박지현 '아름다운 미모'](http://www.segye.com/content/image/2025/11/19/20251119519369.jpg)

![[포토] 김고은 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905507236.jpg)

![[포토] 알리익스프레스, 광군제 앞두고 팝업스토어 오픈](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110714160199219_1762492560.jpg)

![[포토] 박지현 '순백의 여신'](http://www.segye.com/content/image/2025/09/05/20250905507414.jpg)

![[포토] 키스오브라이프 하늘 '완벽한 미모'](http://www.segye.com/content/image/2025/09/05/20250905504457.jpg)

![[포토] '삼양1963 런칭 쇼케이스'](https://image.ajunews.com/content/image/2025/11/03/20251103114008977281.jpg)

![[포토] 언론 현업단체, "시민피해구제 확대 찬성, 권력감시 약화 반대"](https://image.ajunews.com/content/image/2025/09/05/20250905123135571578.jpg)

![[포토] 김고은 '상연 생각에 눈물이 흘러'](http://www.segye.com/content/image/2025/09/05/20250905507613.jpg)

![[포토] 아이들 소연 '매력적인 눈빛'](http://www.segye.com/content/image/2025/09/12/20250912508492.jpg)

![[포토]끝내기 안타의 기쁨을 만끽하는 두산 안재석](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.0df70b9fa54d4610990f1b34c08c6a63_P1.jpg)

![[포토] 한샘, '플래그십 부산센텀' 리뉴얼 오픈](https://image.ajunews.com/content/image/2025/10/31/20251031142544910604.jpg)

![[포토]두산 안재석, 연장 승부를 끝내는 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.b12bc405ed464d9db2c3d324c2491a1d_P1.jpg)

![[포토] 키스오브라이프 쥴리 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905504358.jpg)

![[포토] 아홉 '신나는 컴백 무대'](http://www.segye.com/content/image/2025/11/04/20251104514134.jpg)